5 financial literacy tips for young professionals: Your holiday financial toolkit

The holidays are here, and for young professionals, it’s the perfect time to reflect on your financial habits. Whether you’ve landed your first job, are navigating higher paychecks, or just trying to get by in this cost-of-living crunch, boosting your financial literacy can set you up for success in 2025 and beyond.

Here are five practical tips to kick off your financial journey as you sip eggnog and plan for 2025.

1. Set clear financial goals 🎯

Let’s be real – saving without a goal can feel like running a race without a finish line. Start by asking yourself: what are you working towards?

Is it a summer Euro trip in 2025?

Saving for a new car?

Building a deposit for your first home?

Securing your financial future with early retirement plans?

“While 72% of 27- to 34-year-olds have a financial goal, 33% are not on track to achieve it.”

Having a clear goal gives you purpose and motivation. According to a recent Moneysmart survey, having clear goals helps young Australians feel more in control of their finances. Break your goal into smaller, achievable milestones and create a timeline for when you want to reach each step. For example, if you’re saving $5,000 for a big holiday in 18 months, divide it into monthly savings targets. It’s easier to hit a goal when you know exactly where you’re heading.

“Australians who write down financial goals are 42% more likely to achieve them.”

💡 Tip: Use online goal calculators, like Moneysmart’s savings calculator, to figure out how much to set aside each week or month to hit your target.

The best gift you can give yourself this season is clarity on your financial goals.

2. Track your spending and build a realistic budget 🛍️

Budgeting sounds boring. But you know what’s worse? Realising you’re broke two weeks before payday. Budgeting doesn’t have to be about giving up everything fun – it’s about being smarter with what you have.

Start by tracking your expenses. Grab a coffee, open your banking app, and take a hard look at where your money’s going. Dining out, subscriptions, shopping sprees – they all add up. Once you know your spending habits, you can create a budget that works for you.

One popular method is the 50/30/20 rule:

50% for needs (rent, utilities, groceries).

30% for wants (entertainment, dining out).

20% for savings or debt repayment.

If that’s too rigid, try the bucket budgeting method, which groups your income into categories you can adjust as needed. Try the ASIC Moneysmart Budget Planner to categorise your spending

💡 Stat: According to a 2024 report by Finder, over 57% of young Australians struggle with budgeting due to rising living costs. Don’t let that be you – take charge now!

3. Start an emergency fund (yes, even during the holidays!) 🎁

Life happens – cars break down, unexpected bills pop up, or your housemate decides to move out and take the washing machine with them. Having an emergency fund can save you from spiralling into debt when the unexpected hits.

Start small. Aim for 3-6 months’ worth of essential expenses (think rent, groceries, and bills) as your ultimate goal, but even $1,000 can be a great safety net. If saving feels daunting, automate it. Set up a direct debit to move a small amount into a separate savings account every payday.

Example: Putting aside just $20 a week adds up to $1,040 in a year. That’s enough to cover most minor financial hiccups without stress.

💡 Stat: Research from Moneysmart shows that fewer than half of Australians have an emergency fund. This festive season is the perfect time to start yours.

“Saving just $20 a week can turn into $1,040 by next Christmas.”

4. Invest in yourself through protection and financial literacy 📘

As a young professional, your biggest asset is, well, you. Think about it: your income is the foundation of your financial life. That’s why protecting it should be a top priority.

Unexpected illnesses or injuries can derail even the best financial plans. Income protection insurance ensures that if you can’t work due to illness or injury, you’ll still receive a monthly benefit to cover your living costs. Similarly, trauma insurance or critical illness cover provides a lump sum payment if you’re diagnosed with a serious illness, helping you focus on recovery without financial stress.

💡 Stat: A report by Rice Warner shows that young Australians are underinsured, with many unaware of how income protection or trauma insurance can safeguard their finances.

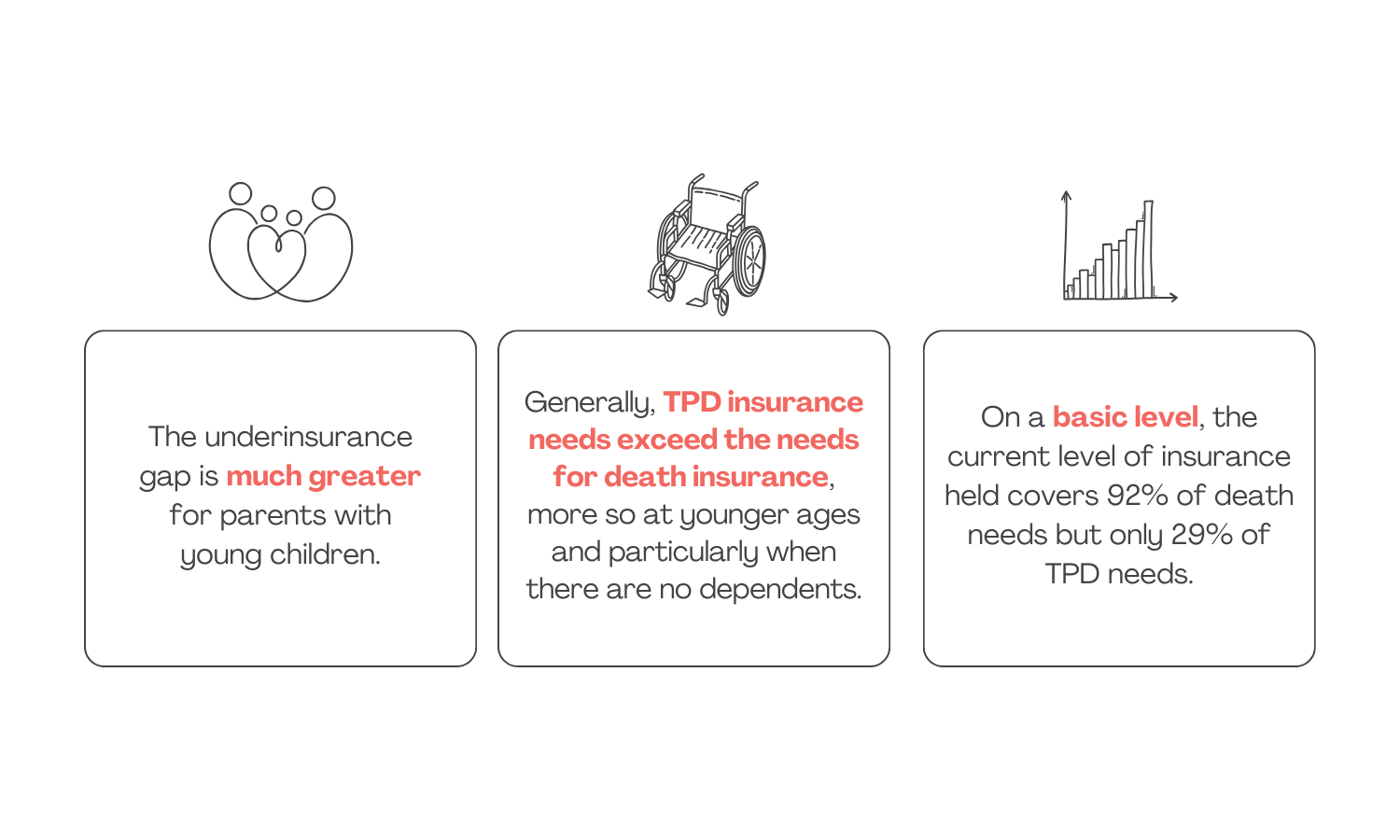

Rice Warner's latest underinsurance report revealed a massive gap in the community when it comes to having enough insurance cover. Here's the breakdown:

$471 billion for basic life cover

$3,435 billion for income replacement life cover

$10,870 billion for TPD cover, and

$611 billion for income protection cover per annum

Source: Rice Warner Superannuation Efficiency and Competitiveness Submission to the Productivity Commission

Superannuation: The challenge of default cover

Superannuation is often seen as a safety net for insurance, but default cover provided by most super funds doesn’t fully meet the insurance needs of many families. According to Rice Warner, the median cover from super funds only meets about 65% to 70% of basic death cover needs for average households. For families with children, the gap is even bigger.

“Young Australians are underinsured, leaving 65% financially vulnerable during unexpected life events.”

Why the shortfall? Default cover through super isn’t personalised. Trustees have a tough job balancing affordability and adequacy of cover for a wide range of members, whose needs can vary based on income, family size, and life stage. Plus, rising premiums in today’s market make it even harder for funds to strike this balance.

If you’re relying solely on super for your insurance, it’s worth asking: is it enough? Reviewing your default cover and supplementing it with additional life insurance or TPD cover might make all the difference in protecting your loved ones.

5. Check in with your finances regularly 🔄

Financial literacy isn’t a one-and-done thing – it’s a habit. Just like your physical health, your financial health needs regular check-ups.

Review your budget monthly: Did you overspend? Can you save more next month?

Track your progress towards financial goals and adjust timelines as needed.

Learn something new: Take an online course, read blogs, or subscribe to finance podcasts to stay informed about taxes, superannuation, and money-saving hacks.

“The key to financial success is consistency – even small, consistent actions can lead to big results over time. ”

Final thoughts

This holiday season, take a moment to reflect on your financial habits and goals. Financial literacy isn’t about being perfect with money – it’s about building the confidence to make informed decisions and take control of your future.

Whether you’re creating a budget, starting an emergency fund, or securing income protection, every step you take gets you closer to financial security and peace of mind.

Need help planning your financial journey? Chat with a financial adviser to set yourself up for a brighter, stress-free 2025.

Sources

Australian Government - Moneysmart Saving Goals Calculator

Finder - Cost of Living Report 2024

Rice Warner - Underinsurance in Australia 2024

Moneysmart - Emergency Fund Basics