Financially preparing for Baby #2: Smart money moves for your growing family

Expecting a second child? Congratulations! While you may already be a pro at diaper changes and late-night soothing, your financial landscape is about to experience a few changes of its own. Growing your family means taking a closer look at your budget, expenses, and future financial goals.

In this blog, we'll explore some essential steps to help you prepare your finances for the arrival of your second child. Let's make sure you're ready to welcome your new addition with confidence and financial stability.

Slash that debt!

Debt can be a pesky burden that lingers like a stubborn stain, and it becomes all the more pressing when you're gearing up for the arrival of another little one. Let's face it, kids don't come cheap, and the costs can pile up faster than you can say "diaper change." On average, each child adds nearly $13,000 to an annual family budget, and that's not even considering future college expenses!

So, it's time for a sit-down chat with your partner. Take a good look at your current debts, and figure out a strategy to tackle them head-on. Review your household budget to identify potential areas for trimming expenses, allowing you to redirect some of that hard-earned cash toward debt repayments.

Source: Care.com

📞Connect with HR

When preparing for a new addition to your family, it's essential to be in the know about the benefits your workplace offers. This is especially crucial if you've recently changed jobs, as your benefits may differ from your previous gig. Reach out to your company's HR department to inquire about the impact on your health and dental cover due to the new family member. Also, confirm the details of both paid and unpaid family leave options to ensure you have the time you need to bond with your expanding family. Your HR team can provide valuable information to help you plan and make the most of your benefits. 🤝

🍼 Baby on a budget

Having a second child doesn't mean you have to break the bank. Take stock of the big-ticket items you already have, such as a crib, car seat, and stroller, as they can save you a bundle on baby expenses. You may also have some infant clothes, feeding equipment, and bottles tucked away. However, there are likely a few items you'll need to update or replace. Consider hosting a "sprinkle," a smaller-scale baby shower, to gather support from family and friends. It's a great way to fill in the gaps in your baby gear collection and keep your budget in check. Explore discounts and programs that can help lower the costs of essentials like formula and diapers, making budgeting for your growing family a breeze. 💸

Find free baby sample sources and how you can get them here.

Life insurance check up

When you've got a new baby on the way, it's not just diapers and baby gear you need to think about. Take a moment to review your current personal insurance plan. Ensuring your loved ones are well-protected is crucial, especially if the unexpected happens. As your family expands, it's a smart move to reevaluate your life insurance cover and make sure it aligns with the growing needs of your loved ones. Life changes, so should your coverage.

Boost the college fund

Got a 529 plan in place for your little one? Consider getting your family members involved. Encourage them to chip in for special occasions like birthdays and holidays. It's a great way to give your child a head start on their college savings journey.

Prepare for the future

With more kids on the horizon, it's time to think long-term. Your home and car may be just right for now, but as your family grows, consider potential upgrades. More space and safety might be in order.

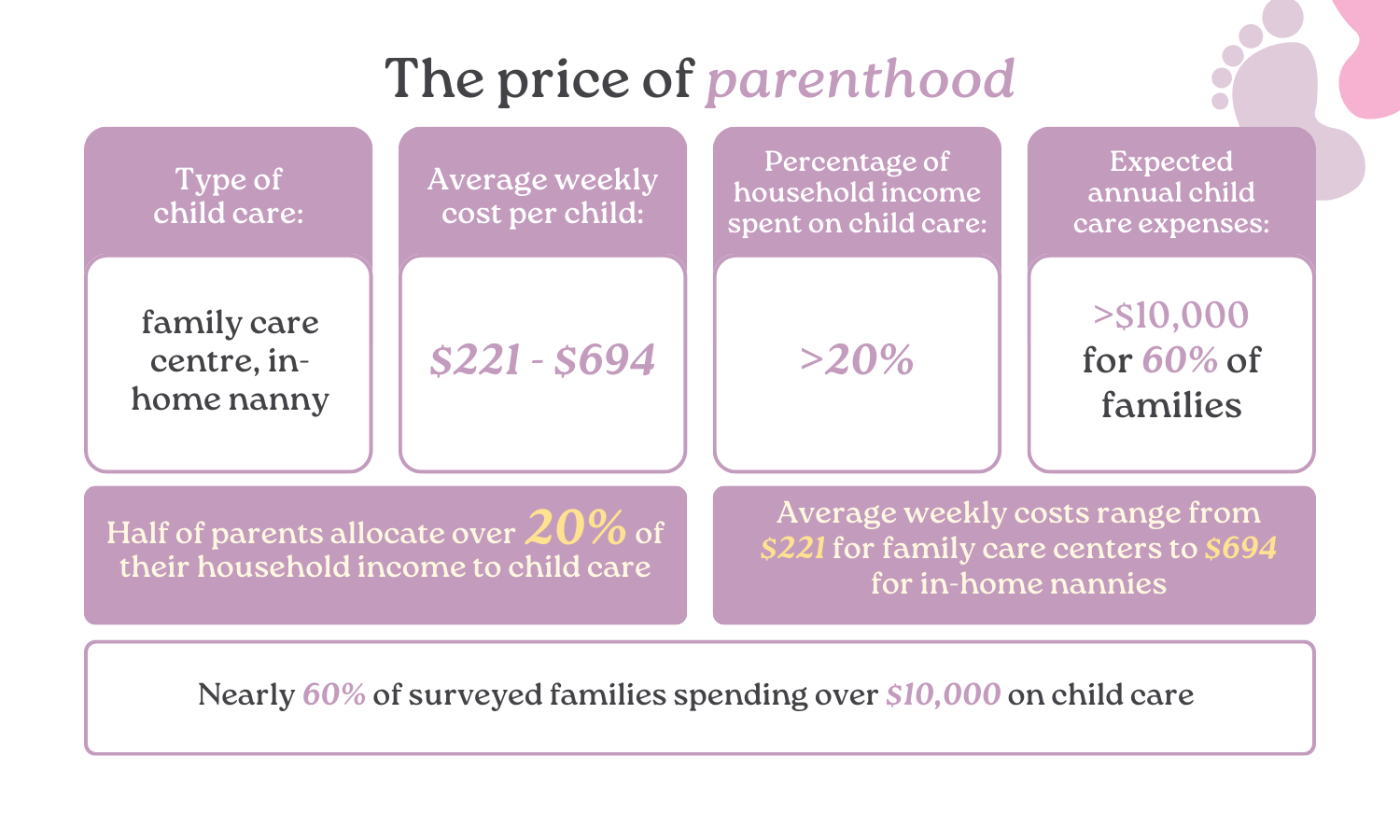

Childcare is another crucial aspect. Can your current setup handle the load, and what's the cost? Moving closer to family could be an option to cut expenses.

And what about your income? Will you or your partner seek more work flexibility or even take a career break? These are big decisions. Chatting openly with your partner can ease the financial transition.

Preparing for a new bub is an adventure. Sorting out your finances in advance means one less worry when your bundle of joy arrives. 🍼💰