A tale of three policies: Why selecting insurance through super or direct from insurer is not always a good idea

Having adequate personal insurances is one of the keys to building strong financial foundations. Often when you hear people talk about personal insurance (think life or income protection insurance), they’ll say that it seems much cheaper to go through their super fund or directly to the insurance company, as opposed to engaging the assistance a financial adviser.

Could it be that people are worried about the costs associated with engaging an adviser? Maybe they don’t know who to trust, or maybe friends (who have never made an insurance claim) are telling them that the DIY approach is best? Bearing these doubts in mind, we thought to write the following story about the three little pigs building their sound financial house (income protection policies) to withstand a menacing wolf (an unexpected illness that prevents them from working).

The tale of 3 little pigs

Once upon a time, there were three little pigs who all wanted to set up a house to protect them against the Big Bad Wolf. This house, in this story, is representing what we know as income protection.

Pig #1 already had a small, cookie-cutter house that was given to him automatically when he purchased the land (or opened a superannuation account). However, it was made of cheap materials and the walls were not as high as he needed them to be. If the Big Bad Wolf came, it would not be enough to protect him.

Pig #2 was feeling confident that he could build his own house and decided to take the DIY approach, so he did so directly with the biggest house building materials company (or insurer) in town. He figured it would be easy and cost-effective, but he'd made a few mistakes and shortcuts along the way when choosing the features, and that his house too wasn't quite what he needed.

Pig #3 was feeling overwhelmed and didn't want to put himself in risk’s way by laying the wrong foundation. So, he consulted with an expert housebuilder at Skye Wealth. They recommended that he go with a company that specialised in strong brick houses, while also providing advice on the right measurements to use, which features were right for him, and how to do so in a way that was cost-effective and well within his budget.

When the Big Bad Wolf (an unexpected illness) came knocking, the first two pigs discovered that their house didn't offer an adequate level of protection, and after a short amount of time, their house came falling down, leaving them exposed to the conditions. Pig #3, however, was able to rest easy as his home was expertly tailored to be wolf-proof, giving him the support he needed in a stressful time.

Though Pig #3 may have spent a bit more money to get the right advice and foundation he needed, it provided with solid, long-term protection against the Big Bad Wolf. Unfortunately, Pig #1's cookie-cutter house was exactly that—basic, cheap, and not the best quality, leaving him vulnerable. Pig #2 had a stronger house, but it wasn’t as durable and lacked some of the features needed to remain strong for the long-term, so he struggled also. Those little pigs would have been in a much better position had they used an expert to navigate building their strong financial house.

The end!

The good, the bad, and the ugly

The good - Sorting out insurance with a financial adviser

If you want to protect yourself from the "Big Bad Wolf" of unexpected illnesses and financial troubles, the best defence is to work with a professional financial advisor. Just like the third little pig in the story who got smart and sought expert advice, you too can have peace of mind by having a custom-made insurance policy tailored to your specific needs and budget. Don't be tempted to go the DIY route, let a qualified professional guide you in finding the right coverage for you. In the end, it's worth the investment for the protection and security it brings.

The bad - Buying insurance directly from retail insurance

Achieving financial security is like playing a strategic game of chess. It requires careful planning and a long-term vision. While it may seem tempting to opt for a quick and cheap solution by buying insurance directly from a retail company, it's important to consider the level of protection and coverage you'll receive. With the help of a trusted financial adviser, you can find an insurance policy that is tailored to your unique needs and goals. This personalized approach may come with an initial cost, but the investment is worth it for the peace of mind and long-term financial security it brings. So, think ahead and make smart moves towards a secure financial future!

The ugly - Trusting that your super fund insurance cover is enough

When facing financial challenges, it's important to have a reliable ally. That's where income protection insurance comes in! A financial adviser can help you find the policy that's perfect for you and provide the peace of mind you deserve. Whether you're facing illness, injury, or other unexpected circumstances, you'll be covered. Don't settle for basic cover from a super fund, take control of your financial security and work with a professional to get the proper cover you need. Invest in peace of mind and protect yourself against the "Big Bad Wolf" of financial uncertainty.

Policy #1 Group/Superfund

Benefit: Fully paid through superannuation, low levels of cover are often quite affordable

Disadvantage: Is not guaranteed renewable and some benefits are not available (i.e., trauma cover, etc.) It’s also not tailored to you. This means the company must have stricter criteria for claiming, to avoid paying out exorbitant sums.

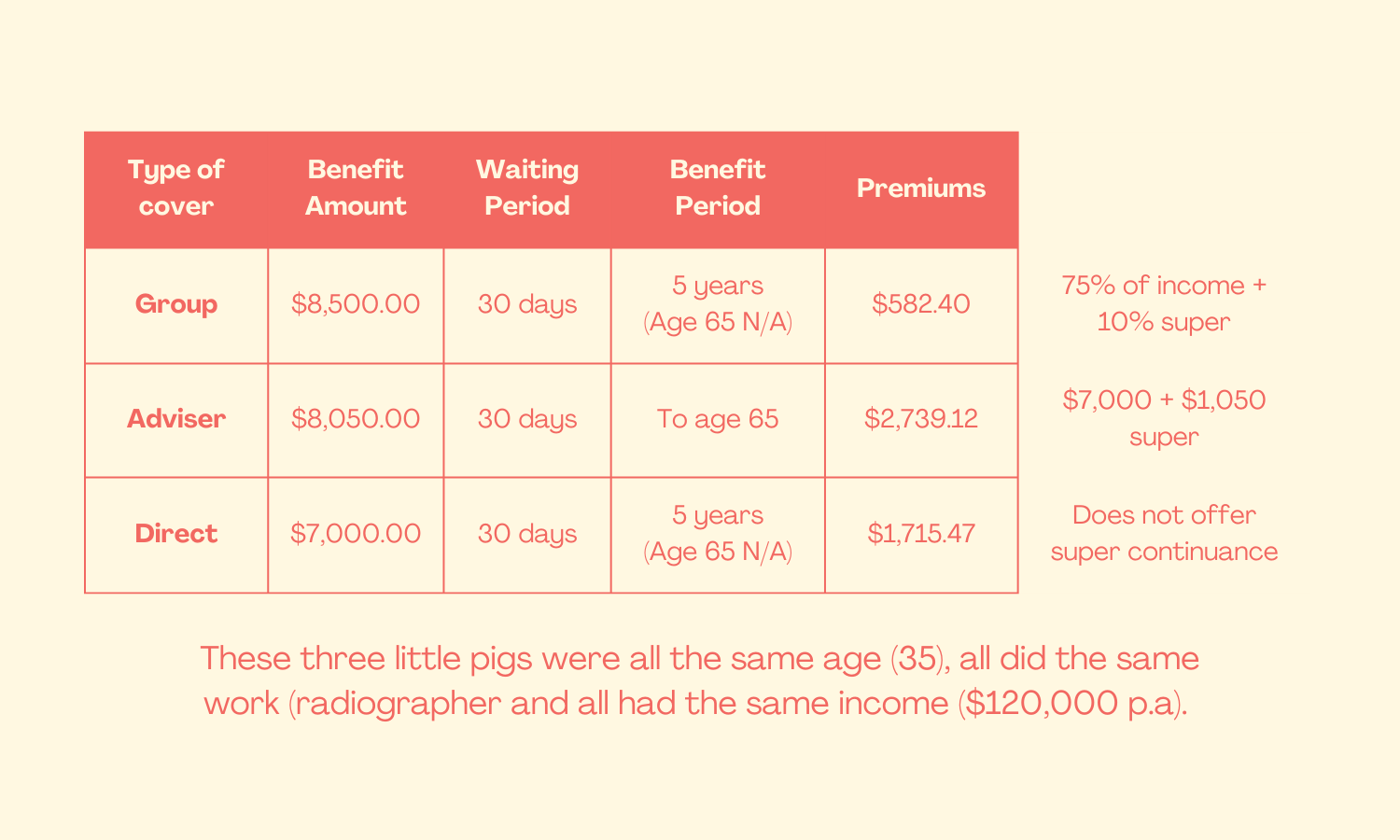

Why we don't want it: Policy #1 Group/Superfund from CBUS Super IP Quote might seem like a sweet deal, with an $8,500.00 benefit amount, 30-day waiting period, 5-year benefit period, and with a premium fully paid through superannuation. However, it's probably best avoided by those in need of long-term security and total protection; as not all the bells & whistles are guaranteed. This means that in times of need; when someone is unable to work due to illness or injury, they may be left without enough money to support themselves and their family. It also means that if someone requires extra medical care in order to make a full recovery this might not be covered in the insurance policy either. For these reasons, Policy #1 should be considered on a case-by-case basis.

Superfunds got you covered, but there's no additional benefits attached. If you get a successful TPD claim, then your income protection will stop—even if that means saying ta-ta long term! On the flip side though, most retail cover policies provide more leeway when defining what qualifies as income protection friendly cover.

So if you're with a Superfund, your monthly benefit will be done if the claim is successful! Whereas if you go through Zurich or TAL, you'll get to keep that sweet pay out coming in each month and use it as desired to pay off debt like mortgages/loans etc., all while continuing on with those same expenses covered by Income Protection.

When it comes to disabilities, you need only 7 days out of 12 consecutive days of being totally disabled for retail cover, but 30 solid ones with a superfund. That's why they call waiting periods 'waiting' instead of going nuts right?

A good retail cover can be beneficial if you find yourself knocked out of action for a while with the sniffs. But don't forget that Superfunds won't be as generous and might leave you high and dry until you've exhausted all your sick leaves. That could hurt—literally AND financially...But here's something worse; members aren't eligible for any temporary incapacity benefits once they start receiving those sick pay outs.

One client had a whopping 1000 hours' worth of sick leave saved up, which is understandable considering she'd been working for the same employer for 40 years! But even with all those days of sickness stored away, if something were to happen and she needed income protection insurance, it still wouldn't kick in until after 6 months! We could use some backup when times are tough like this. And then there's the 30-day waiting period before you can receive income protection, meaning no money coming your way for some time. But if it goes through superannuation and you exhaust said sick leave entitlements, things get worse as two to three days of sick leave won't cut it after six months when needing another claim.

Here's a breakdown of how Australian Retirement Trust pay their Superfund or TPD Assist:

Based on a Date of Disablement on or after 1 October 2020.

If you're insured with Superfund, their TPD is called TPD Assist. Unlike retail cover that pays out the full amount without any further questions asked, there's a catch with this one—it tests you! Every year, they'll make sure (very persistently!) that 'you've still got what it takes to be totally disabled', like making sure we all know who really wears the pants around here or something?! Ideally, TPD will allow you to pay off debts, cover some of your lost income, and leave some left over for medical expenses. Not sure about you but waiting 6 years to be able to pay off your mortgage or afford essential medical treatment isn't ideal.

Another thing—Superfunds don't allow level premiums. They're also not guaranteed renewable, so they can just change whatever they want, whenever they want. Sounds like Superfunds aren't the best option if you want to stay covered, since they don't guarantee renewal and can change up your policy whenever. From tripling premiums to altering benefits—that could definitely put a damper on things! So it pays off make sure whatever cover you get is bang-on for now... no need waiting 'til next year only find out there's some nasty surprises in store.

Superfunds often provide ‘default’ cover to new members who join the fund. They do this without any consideration of that new member’s health, occupation, or other risk factors. This means that you are inadvertently being exposed to that risk, as you’re in the same ‘pool’. Would you prefer to be in a member’s only pool area, where members are carefully screened before being allowed to enter, or would you want the cheaper, public pool where everyone is allowed in, regardless of how ‘noisy’ they are?

Policy #2 Direct

Benefit: You go directly to the insurer and cover can be issued fast.

Disadvantage: More expensive than a super fund policy.

Why we don't want it: Policy #2 Direct with an insurer from Zurich EziCover might sound like a good idea. Sure, it does have a hefty $7K benefit amount but this policy is much more expensive than the group/superfund policy at $1,715.47 for the same cover and does not offer any of the extra benefits that you can get from other policies such as Income Protection to help in recovery from illness or injury. Plus, a benefit period of 5 years? You'd probably end up worse off if something unexpected happened like injury or illness—nowhere near enough money to help get back on your feet again. Our advice: look around at other policies that offer additional perks.

Refering back to our builder analogy above: we all love to think we’re intelligent capable humans who can do anything we put our minds to. While we are for the most part, this doesn’t mean we are experts in every facet of life. Personally, while we might be able to build some kind of shelter with a bit of help from Google and elbow grease, we’d be far more at ease having a professional build our house, while we focus on what we’re good at, and enjoy.

Policy #3 Retail (with a financial adviser)

Benefit: Guaranteed renewable, tailored to YOU, easy!

Disadvantage: Might be more expensive in some cases.

Why we WANT IT: Great for folks seeking long-term financial security and protection – the adviser will work with you to tailor a policy that meets your needs. Although Policy #3 might cost more money, but it can be worth it in the end. It offers $8,050.00 in benefit amount with a 30-day waiting period and cover up to age 65. This policy is guaranteed renewable which means that you will always be covered to age 65. The financial adviser will work with you to make sure the policy fits your needs so that any unexpected events are covered and can help support yourself and your family financially. For example, if someone was injured due to an accident and needed costly medical treatments to recover properly; this policy would cover those costs as well as a portion of their salary while they were unable to work— allowing some peace of mind during difficult times even when finances are tight!

Talking to an adviser also means if cover with all the bells and whistles is out of your budget, they can assist in working towards that budget, without forgoing any important features you may not even know exist. Lowering cover is not the only way to save on premiums! Advisers can also provide insight on methods to decreasing the premiums over the long term, by making small changes today (lowering BMI, quit smoking, having a cash buffer to extend waiting period)