Holiday spending got you rethinking finances? Save with an adviser

The festive season often brings joy, but let’s face it—it can also leave your wallet feeling like it’s gone a few rounds in the ring. As the holiday cheer fades and we step into 2025, it’s the perfect time to take a good, hard look at your finances. Between gifts, celebrations, and those last-minute New Year getaways, your budget might be begging for mercy. But here’s the silver lining: working with an adviser can help you save money in unexpected ways, especially when it comes to life insurance.

The myth: Super fund insurance is cheaper

Over 70% of Australians hold life insurance through their superannuation funds. It’s easy and automatic—premiums come straight out of your super balance, and there’s no need for health checks. However, this convenience often comes with hidden costs and coverage gaps that could leave you underinsured or paying more than necessary.

💡 Stat: Australians held a total of $4.1 trillion in superannuation as of 2024.

The reality: Financial advisers offer better value

1. Lower premiums over time

Super fund insurance premiums tend to increase as you age or require higher coverage levels. According our data, major super funds like AustralianSuper and HostPlus can charge more compared to retail insurers. This trend highlights how retail insurance can deliver better value in the long run.

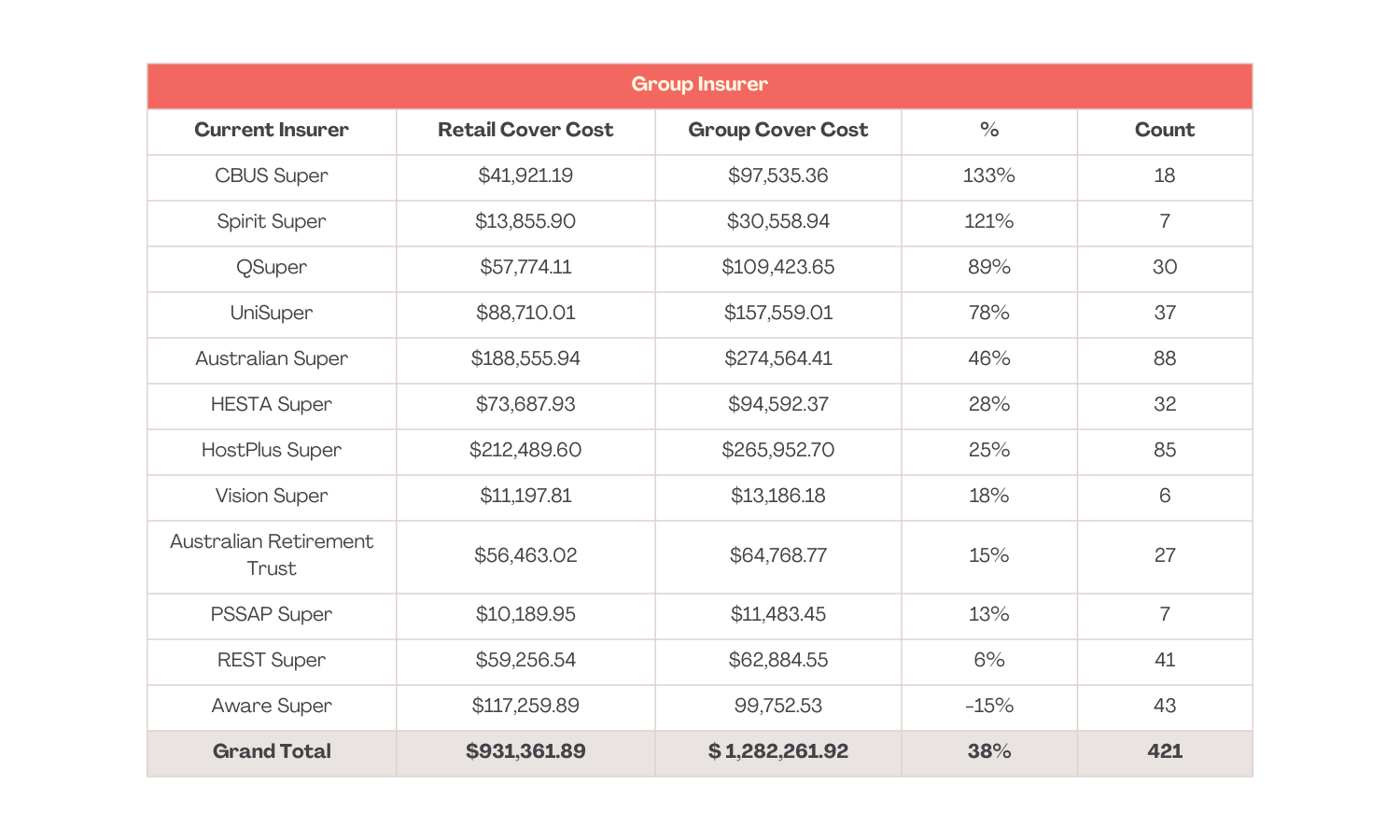

The table below shows the insurance premiums from the 10 largest industry super funds –

Australian Super, Australian Retirement Trust, HostPlus Super, HESTA Super, CBUS Super, UniSuper, Spirit Super, Aware Super, and REST Super (based on member numbers–SuperGuide).

The table also shows the cheapest premium available from the top retail insurers.

In this particular example, all of the super fund premiums are more expensive than the lowest retail premium available.

Table 1: Cost comparison between retails and group cover insurance

Retail vs. Group cover costs for major super funds

2. Fewer hidden fees

While premiums deducted directly from your super balance might seem straightforward, additional admin fees and taxes can quietly erode your retirement savings. The Productivity Commission’s "Superannuation: Assessing Efficiency and Competitiveness" report found that these fees could reduce retirement balances by 14-25% for low-income earners or those with intermittent work histories. By opting for retail insurance via super, you can enjoy greater transparency and control over your costs.

3. Tailored coverage

Superannuation fund policies often take a one-size-fits-all approach, which may not suit everyone. Retail insurance, especially when set up through an adviser, allows for customisation based on factors such as your health, occupation, and financial goals. This flexibility ensures you’re not paying for features you don’t need or missing out on essential coverage.

4. Comprehensive medical underwriting

While group policies rarely require health checks, retail insurance typically involves medical underwriting upfront. This might sound inconvenient, but it’s a safeguard for both you and your insurer. According to ASIC’s "Default insurance in superannuation", claims for pre-existing conditions are often denied under group policies due to the lack of initial medical assessments. Retail policies, by contrast, provide clarity from the outset, reducing the risk of claim disputes.

“We found evidence that some groups of members may have been receiving poor value for money from default insurance. Specifically, we found several instances of claims ratios that are consistently and significantly lower than average, for certain group insurance policies, or for specific groups of members.”

You can access the actual source here: ASIC Report 675 - Default Insurance in Superannuation

Real-world savings example

Given in this example is the annual premiums for $1,552,000 Life and TPD (Any Occupation) and Income Protection cover for a 41-year-old, Computer Programmer, non-smoker, male living in Victoria (super fund premiums sourced from Omnium).

$7,211 annually through AustralianSuper (group policy with low feature score).

$2,962 annually through MetLife (retail policy).

This $4,000+ annual difference underscores the cost-saving potential of working with an adviser to secure retail insurance (source: Skye Wealth internal analysis, 2024).

Why make the switch now?

The New Year is a time for fresh starts, and your finances deserve one too.

At Skye Wealth, we specialise in simplifying the process of sorting life insurance. From comparing options across insurers to navigating the complexities of medical underwriting, we help make sure your coverage fits your needs and budget. Whether you’re recovering from holiday expenses or aiming to make smarter financial choices in 2025, let’s make 2025 a year of financial clarity and control. Reach out today for a personalised consultation.