What are the most common claims for income protection?

Let's face it, claiming on insurance can be a pretty daunting thought. But having income protection in your back pocket gives you that extra bit of security when life throws something unexpected at you. It pays to know you've got some cover if things take an unexpected turn, and that's when income protection can be a lifesaver.

In 2020, AIA paid over $467 million for income protection claims that made a great difference to the people who put their trust in them and helped them enjoy healthier, longer, better lives.

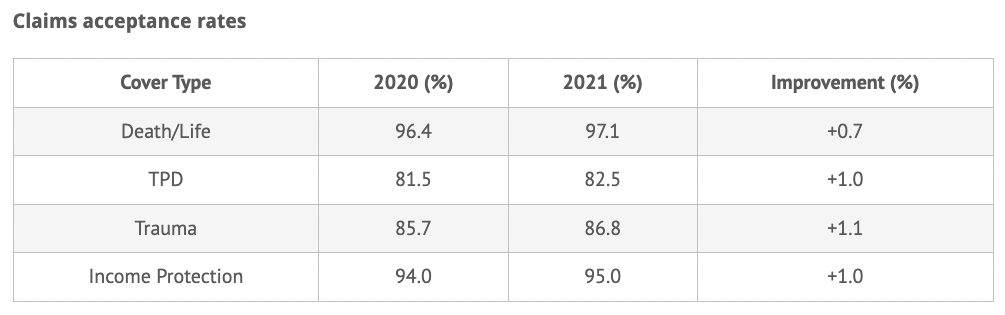

The table below shows the various types of claims and the average claims acceptance rates for policies distributed by life insurance advisers/brokers for the 12-month period ending 31 December 2021.

Top 3 most common claims for income protection

In August 2022, a life insurer released a report that revealed their most frequent 2021 claims for Income Protection Insurance. The top causes were:

Accidents

Musculoskeletal Issues

Mental Disorders

Source : Clearview Life Insurance Claims Report Aug 22 for FY21 period

Safeguarding your financial future in the face of accidents, injury, and mental health

No one likes it when accidents strike—but if they do, income protection could be there to help you out. No matter whether your injury has made work impossible for a while or is here to stay, protecting yourself with insurance covers the financial side of things so you can focus on getting better!

Each day there are around 1,460 people hospitalised for injuries.

Last financial year, TAL paid out a whopping $2.7 billion in claims to over 39k Australians—that's like handing out nearly $52 million per week! And 71% of those went towards helping folks continue keeping on with their lives while they get back on their feet after an accident or injury.

Source: TAL 2021/22 Life insurance claims paid

With income protection, you can rest easy knowing that your finances won't be severely impacted in the event of an illness or injury. It helps you stay afloat with a steady stream of cash—so your bills and everyday living costs will still be taken care of! Your most valuable asset? Yourself!

What is the difference between personal accident insurance and income protection?

Accident only insurance may cover you in case of an unfortunate injury, but wouldn't be much help if a nasty illness stops you from working. Income protection is the way to go for maximum peace of mind—it's designed to keep your income flowing even when those pesky bugs and bumps put you outta action!

Mind over money: The link between mental health and income protection

Did you know that 1 in 5 Australians aged 16-85 report having a mental health condition? Mental illness is a serious and relatable reason to make an income protection claim. In fact, based on FSC-KPMG life insurance claims data from 2019, life insurers paid out $1.24 billion dollars to over 9,500 Australians for mental health claims alone. Whether it's a short-term episode or an ongoing condition, income protection can provide financial support while you take time off work to focus on your mental health and well-being.

Mental health conditions can be tricky to deal with at the best of times, so why not make sure you're financially secure in case things don't go as planned? Let nothing come between you and safeguard your well-being today.

Claims story on long COVID

At Skye we were able to help a client on a claim who couldn't work due to long COVID and then had symptoms like chronic fatigue syndrome—and was easily able to file a claim with Skye's and NEOS's help.

Our client describes her experience with long COVID and how it affected her. She got COVID for the first time in December 2021. So, it was Christmas Eve and she felt pretty rotten over a fortnight. She tried to go back to work but struggled because she couldn't deal with the pressure while also trying to give herself enough time to recover—which is what all the advice said at the time.

In total, it took nine months from first experiencing symptoms to filing her claim because she thought she wasn't qualified for a claim at all. But thanks to the help of her adviser at Skye and NEOS, she received her pay out in full without any issues. The only difficulty was compiling all the necessary medical records and the fact that she was in and out of work—but even in that situation, the team at Skye offered support and guidance throughout the tricky process of lodging her claim. The team made sure everything was in tip-top shape so that things ran as smoothly as possible.

Overall, she found the experience with NEOS and Skye positive and the claims process was much easier than she expected. Having income protection has taken a lot of pressure off her without having to go to work when she was sick, which was an important part of recovery.

With the right support, it can be an easy process. And if suddenly you're not bringing in an income, income protection can help ensure your bills are covered.

A smart way to prepare for the future

Income protection is designed to help keep you afloat financially if something happens that prevents you from working. Whether it's job loss due to illness, injury, or accident, it's good to know you have a safety net in place to help get through tough times. If you'd like to find out more about how income protection works or want to get advice, have a chat with us today!

It's always better to be prepared and have income protection in place, rather than being caught off guard and not having any financial support when you need it the most. Have that peace of mind today so you can crack a cold one tomorrow hanging by the beach worry-free.