What do Australians most often claim on life insurance?

We've all had those thoughts about whether our life insurance will actually come through when we need it most, right? So we're here to clear the air and give you the real deal on how life insurance claims pan out. You might have come across the idea that insurance companies are a bit tight-fisted when it comes to paying up. But let's get down to business and take a look at the cold, hard claims data. It's time to separate fact from fiction and find out what's really happening with life insurance claims here in Australia.

A closer look at life insurance claim success rates

The newest stats rolled out by the Australian Prudential Regulation Authority (APRA) show that over 90% of life insurance claims were successful. Now, that's a heartening outcome for Aussie families who are up against the ropes – be it due to serious illness, injuries that put a halt to work, or the painful passing of a family member they relied on.

As for the claims that don't quite get the nod, they're quite a rarity. Typically, the hitches arise when there's a bit of a mismatch between the reason for the claim and the nitty-gritty of the policy's terms and conditions. For instance, if someone tries to lay a claim based on a medical hiccup that was already in the cards before the policy came into play, it might hit a snag. Same goes if a pre-existing condition wasn't put on the table when the insurance was initially sorted.

But here's the good oil: insurers aren't ones to turn a blind eye. They'll often suss out the situation to weigh in and consider and maybe even give you some different policy options so you can still get covered wherever possible and reasonable.

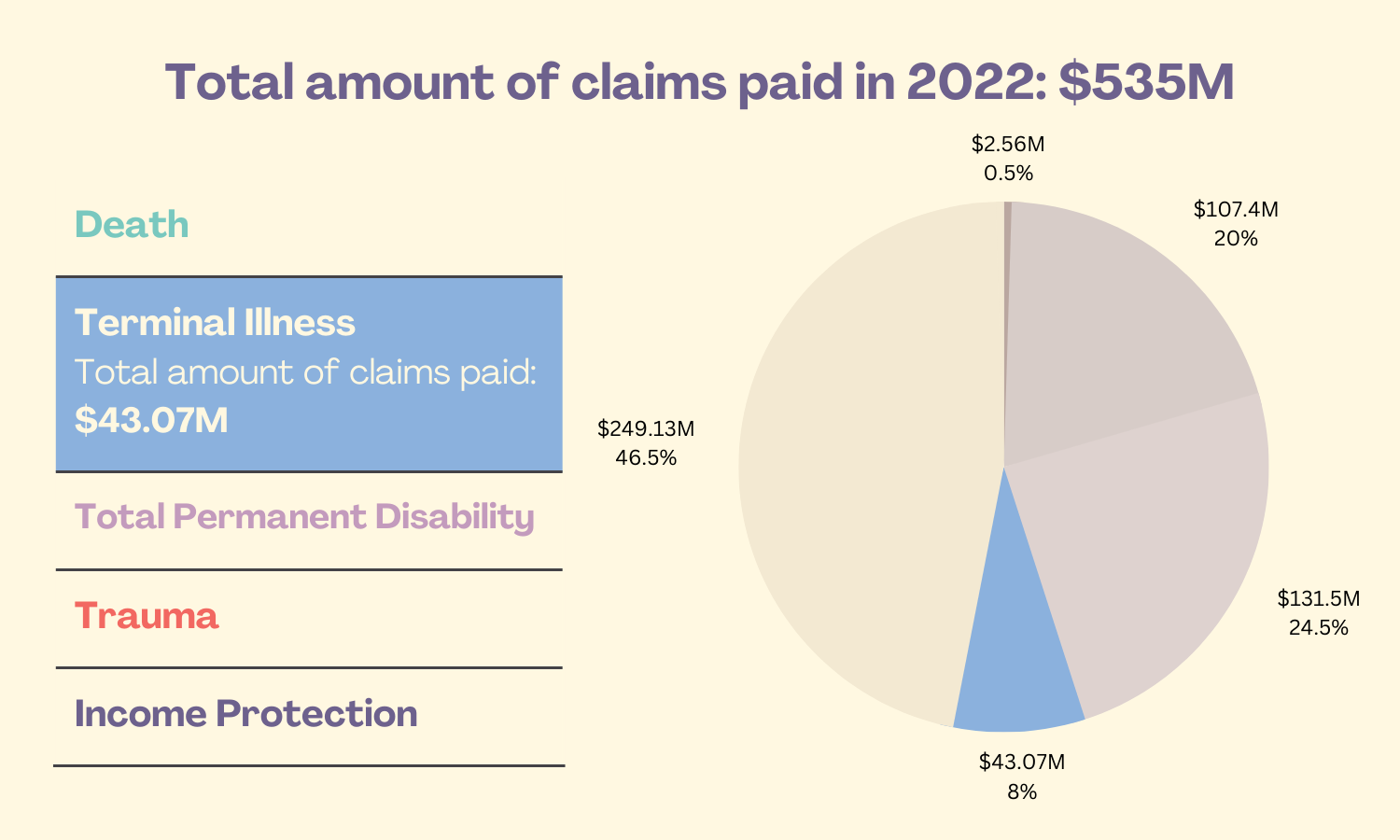

Here's an overview of the claims insurers paid in the last years.

Source: MetLife Australia

Source: Zurich Insurance Group. For a list of top causes of claims, please see here.

Your chances of a successful claim

Your claim's success often boils down to two crucial things: knowing the ins and outs of your insurance and getting your initial application as accurately as possible. APRA has served up some gems in their Life Insurance Claims and Disputes Statistics for December 2022. The numbers show that you’re more likely to have a successful claim when you go through an adviser when sorting your insurance, rather than going through it alone.

Let's dial in on some stats from the period spanning June 2018 to December 2022:

87% of total and permanent disability (TPD) claims were successful where the policy was taken out through an adviser, compared to 77% where the customer purchased their insurance on their own

95% of income protection claims for adviser-purchased policies were successful, compared to 89% for individually purchased policies.

With a financial adviser on board, you're tapping into their expertise to match the policy with your needs. So, while flying solo isn't a dead-end, going through an adviser is like having a co-pilot who's been down this road before. So, if you're looking to amp up the success of your life insurance claim, you know which way the wind's blowing.

Sorting out insurances might have its twists and turns, but with a bit of savvy planning, you're setting yourself up for a smoother ride. So, don't hesitate to connect if you're ready to take the reins and steer your life insurance plans in the right direction. Your peace of mind is worth every bit of effort, and we're here to guide you every step of the way.